Overview of the Bahrain Stock Exchange (Bahrain Bourse)

A comprehensive overview of the Bahrain Stock Exchange (Bahrain Bourse), analyzing its market structure, regulation, liquidity characteristi...

Practical educational content to help GCC investors understand markets, brokers, and trading concepts before making real decisions.

A comprehensive overview of the Bahrain Stock Exchange (Bahrain Bourse), analyzing its market structure, regulation, liquidity characteristi...

An in-depth analysis of the Kuwait Stock Exchange (Boursa Kuwait), explaining its structure, regulation, market behavior, and strategic rele...

A senior-level analysis explaining when stocks make more sense than diversified asset trading, focusing on correlation risk, time horizons, ...

A senior-level analysis comparing stocks and alternative assets from a conservative investing perspective, explaining capital durability, tr...

A senior-level analysis explaining why stocks are fundamentally easier to analyze than other assets, focusing on cash flows, accounting stru...

A senior-level risk analysis comparing stocks and speculative assets, explaining how permanent capital risk, time horizons, and recovery dyn...

A senior-level analysis explaining why stocks reward patience more than other asset classes, how time reduces risk in equities, and why GCC ...

A senior-level analysis comparing stocks with short-term trading assets, explaining how time, risk, costs, and behavior differ for GCC inves...

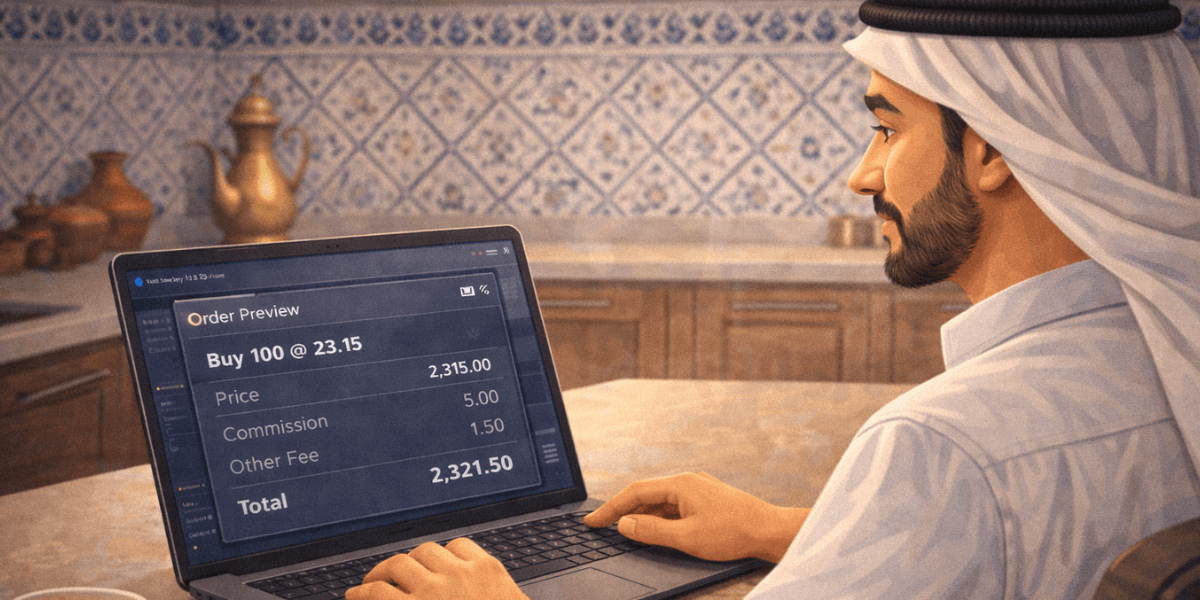

A senior-level analysis of the hidden costs embedded in stock trading platforms, explaining how execution, spreads, FX mechanics, and behavi...

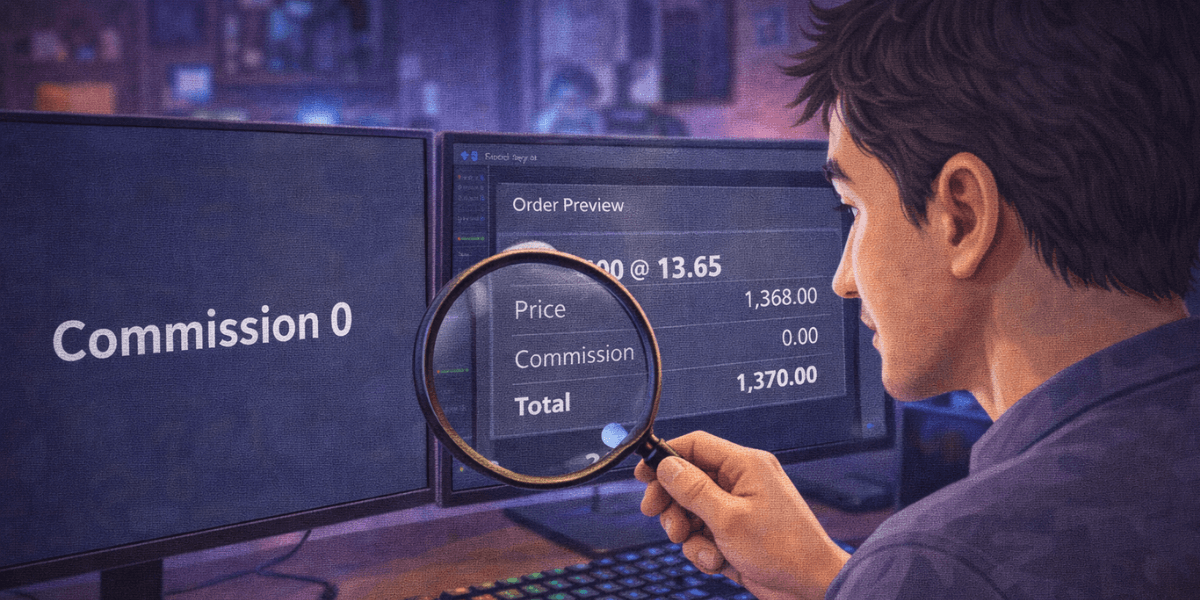

A senior-level analysis explaining how commission-free stock trading actually works, where platforms embed hidden costs, and how GCC investo...

A deep, senior-level analysis of how brokerage fees quietly erode long-term investment returns, distort compounding, and shape portfolio out...

A detailed analysis of stock trading fees and commissions, including spreads, execution costs, and FX charges, and why GCC investors consist...

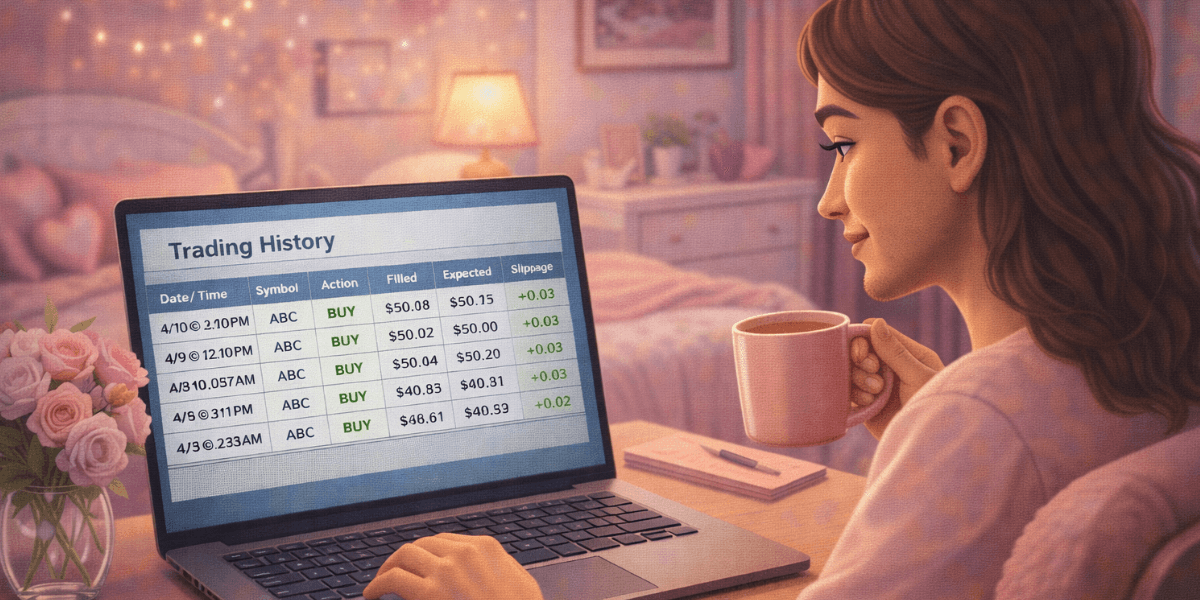

An in-depth analysis of how trading platforms calculate and display portfolio performance, why those figures can mislead investors, and how ...

An in-depth analysis of how stock trading platforms display prices and quotes, what those numbers really represent, and how GCC investors sh...

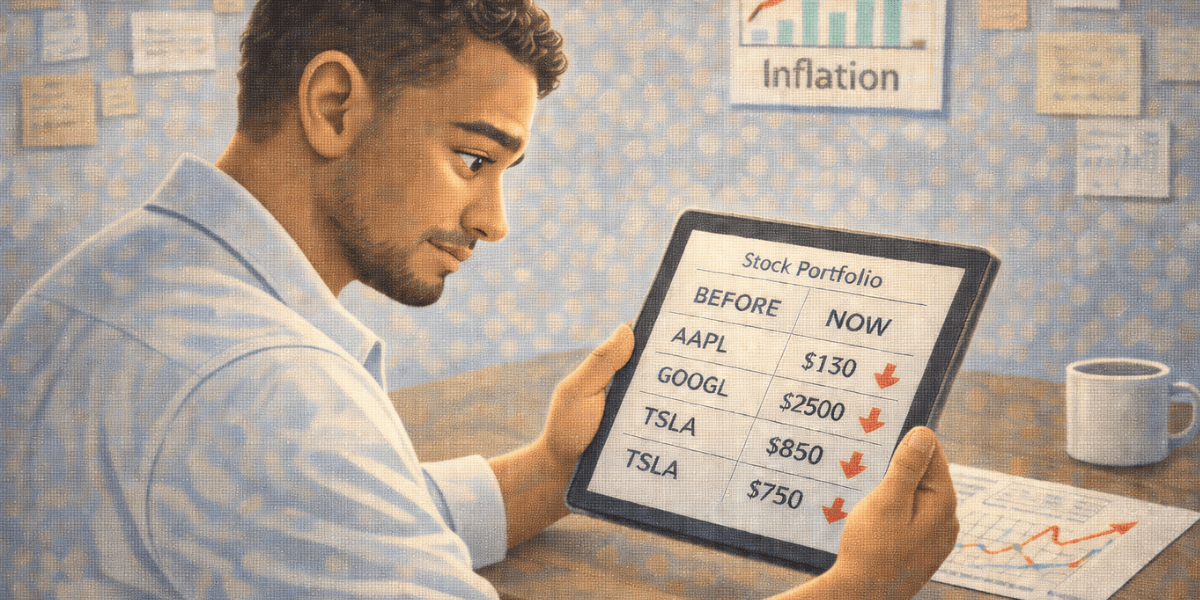

An in-depth analysis of how investors can recover from portfolio drawdowns, rebuild capital structurally, and redesign risk exposure from a ...

A deep, senior-level analysis of how drawdowns function in stock investing, why they dominate long-term outcomes, and how GCC investors shou...

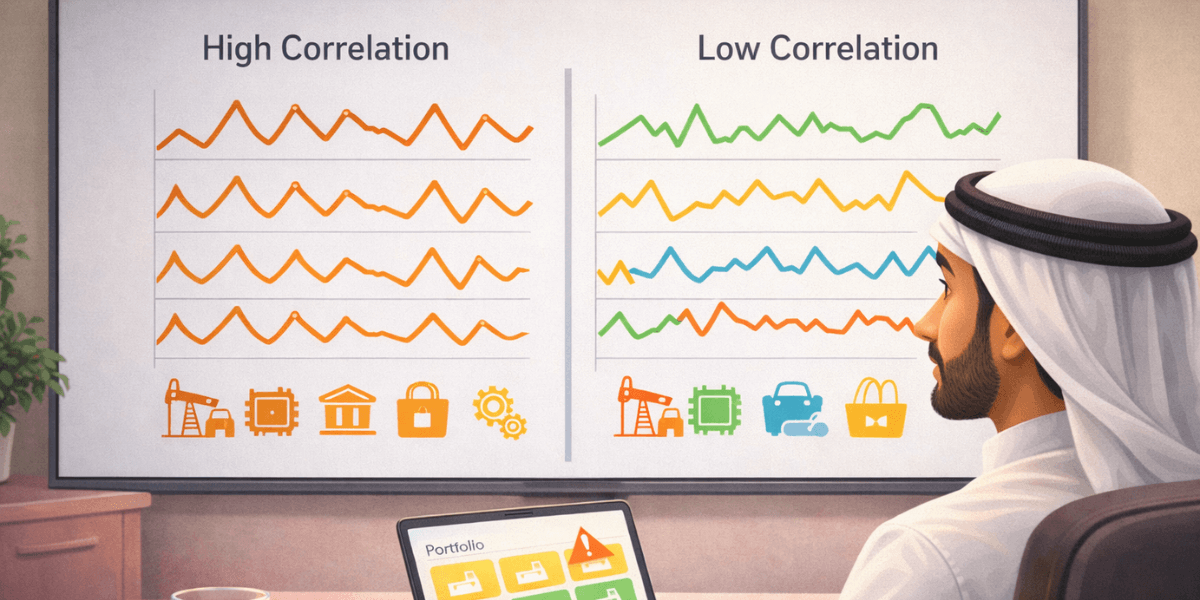

A senior-level analysis of how market volatility reshapes portfolio risk, exposes hidden correlations, and impacts long-term capital preserv...

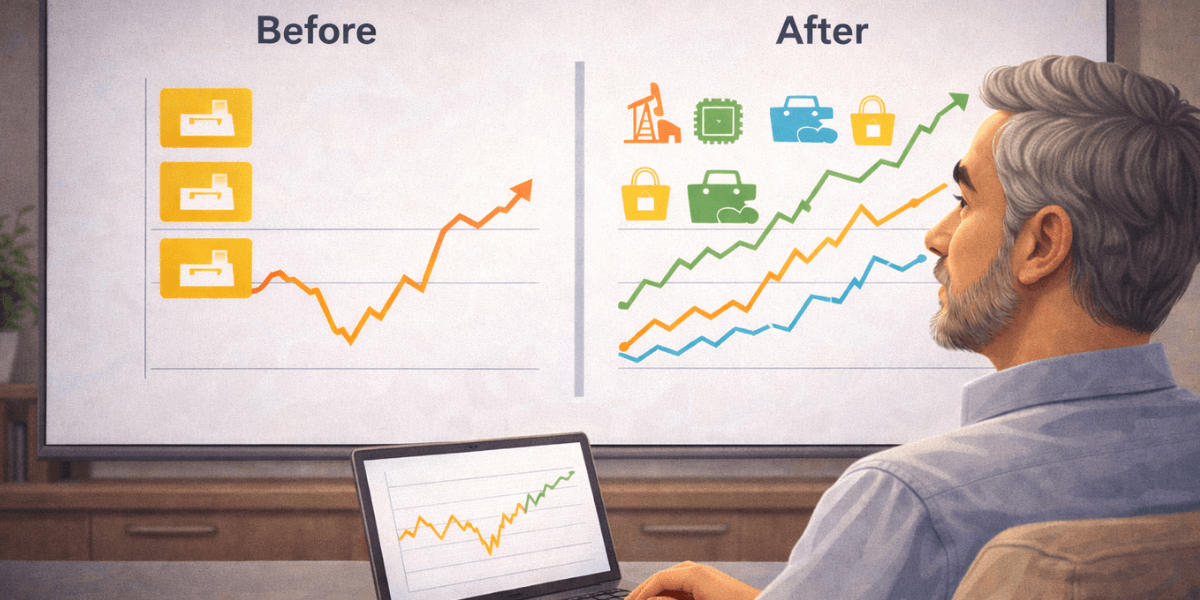

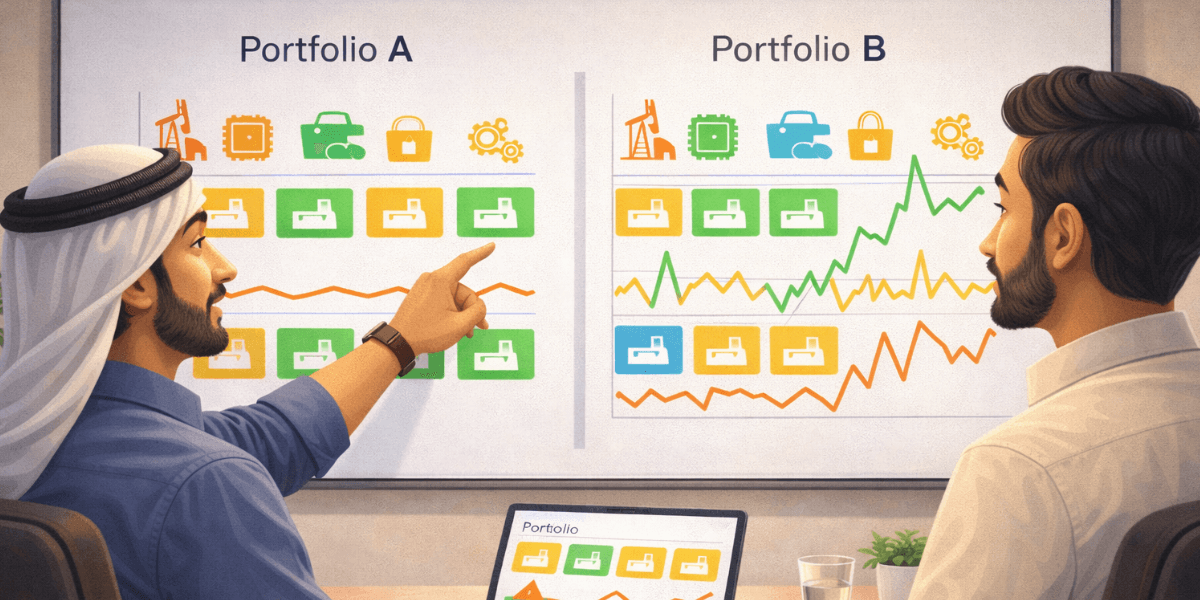

A deep analytical essay on how correlation shapes stock portfolio risk, diversification failures, and long-term capital preservation, writte...

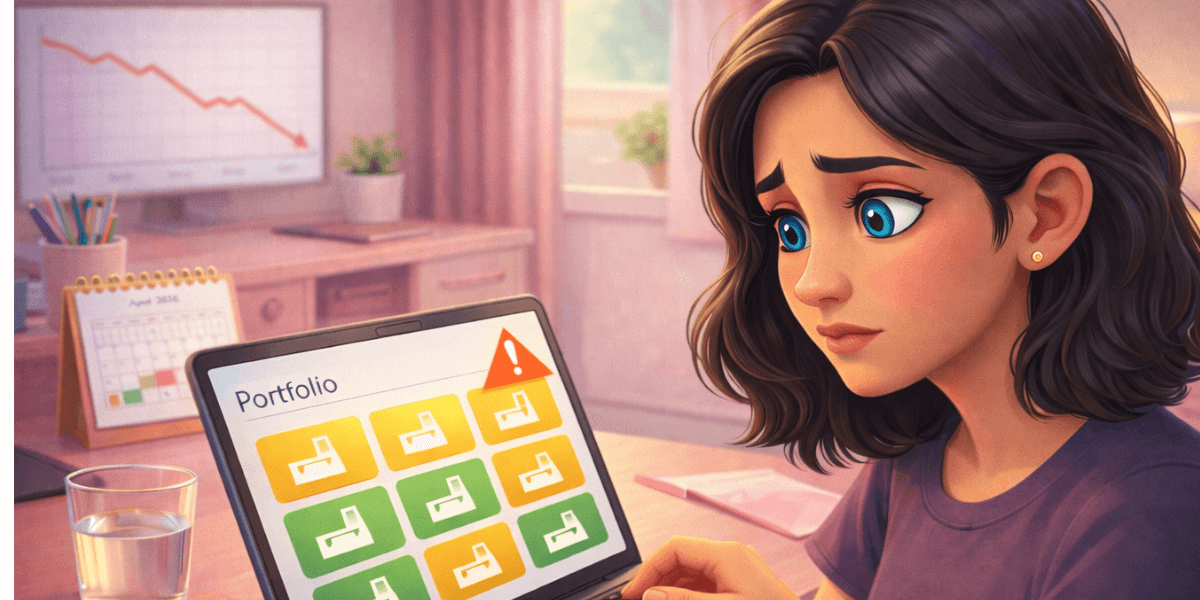

Learn how sector concentration increases portfolio risk, why superficial diversification fails, and how GCC investors can manage structural ...

Understand how falling inflation affects stock markets, from valuation multiples and earnings expectations to sector rotation and investor b...

Discover which stocks perform better during high inflation, why pricing power and balance sheet strength matter, and how GCC investors can p...

Understand how inflation reshapes stock valuations through discount rates, earnings durability, pricing power, and investor behavior, with a...

Discover why stock markets move before Federal Reserve decisions, how expectations and probabilities are priced in advance, and how GCC inve...

Learn how to interpret Federal Reserve announcements as a stock investor, understand expectations, market reactions, and policy signals, wit...

Understand how Federal Reserve decisions influence stock prices through interest rates, liquidity, valuation, and global capital flows, with...

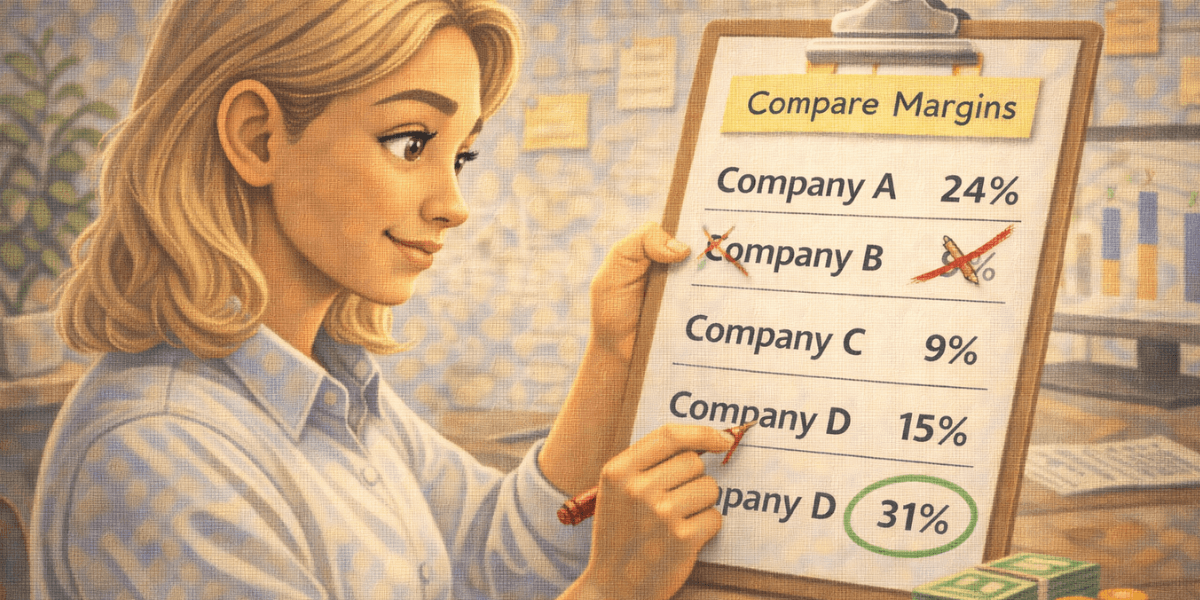

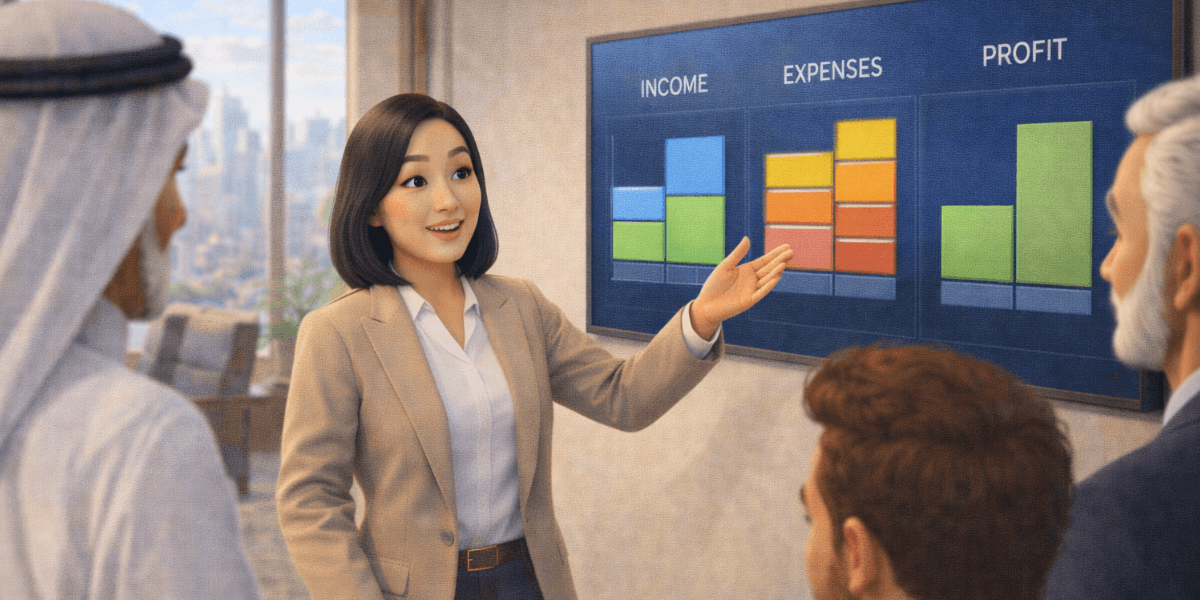

Learn how to compare companies using profit margins by understanding pricing power, cost structure, and durability, with a disciplined frame...

Learn what profit margins reveal about pricing power, cost discipline, and competitive strength, and how GCC investors should analyze margin...

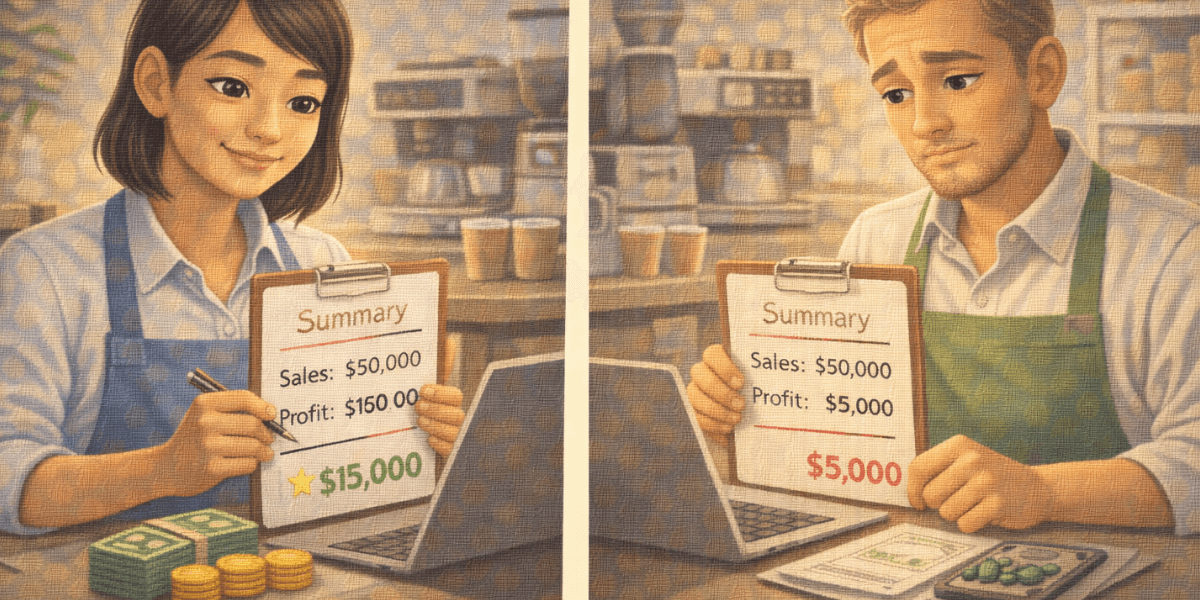

Learn what revenue growth really means, when it creates value, when it destroys capital, and how GCC investors should analyze growth beyond ...

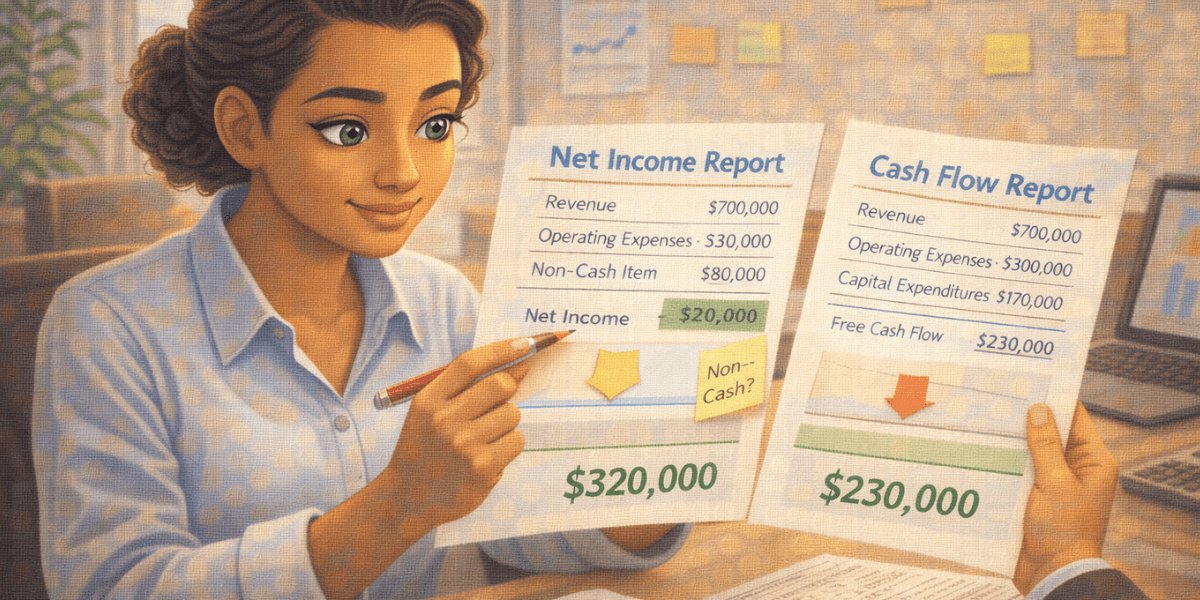

Learn how to analyze free cash flow properly, identify sustainable cash generation, avoid accounting distortions, and evaluate long-term bus...

Learn what free cash flow means in stock analysis, why it matters more than earnings, and how GCC investors can use it to evaluate real busi...

Discover how Return on Equity (ROE) reveals true business quality, capital efficiency, and management discipline, with a long-term framework...

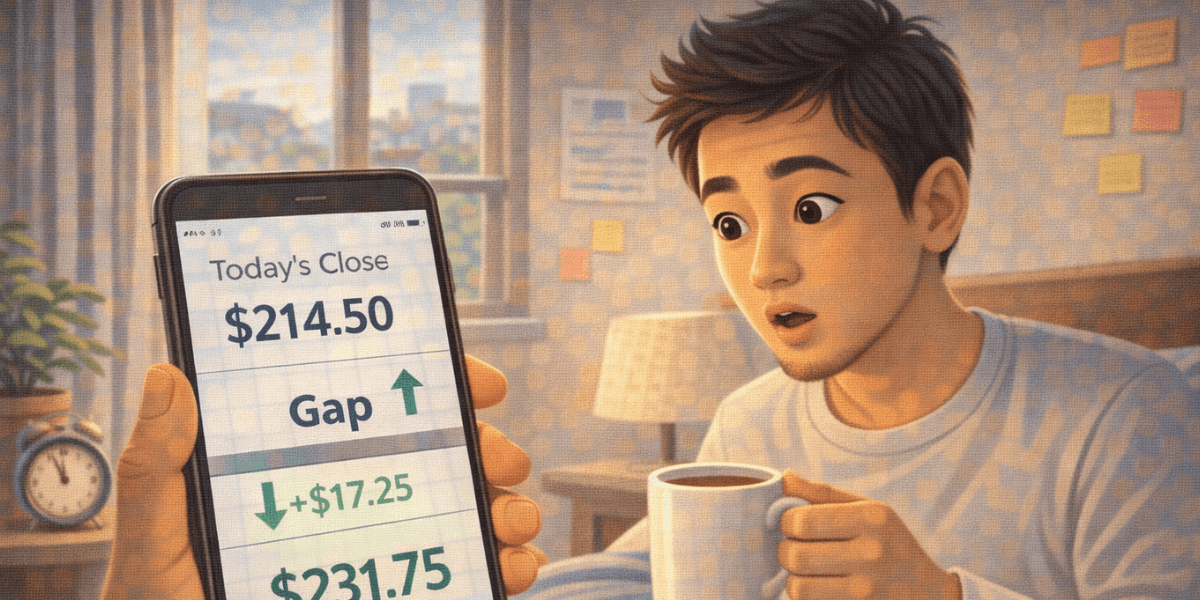

Understand how stock price gaps form, when gaps tend to fill, when they don’t, and how GCC investors should approach gap trading with ...

Understand the key differences between pre-earnings and post-earnings stock trading, how risk and volatility change around earnings, and why...

Learn how earnings reports affect stock prices by reshaping expectations, triggering repricing, and driving volatility, with a clear framewo...

Understand earnings-based trading strategies, how earnings announcements reshape expectations, trigger volatility, and why GCC investors mus...

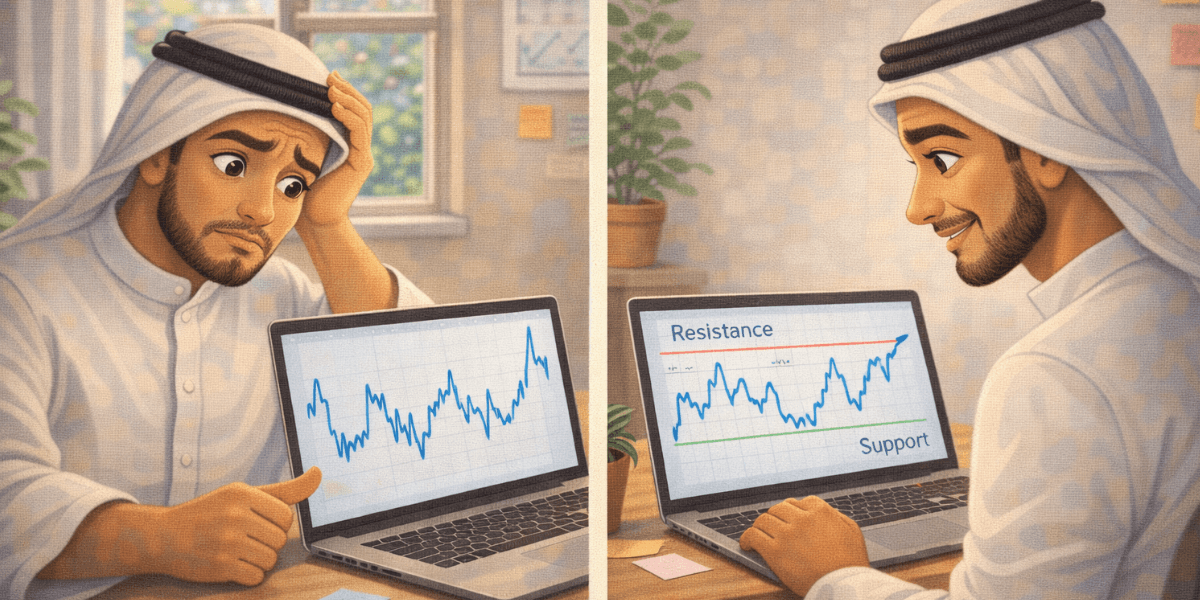

Learn how range trading strategies work in stocks by understanding market equilibrium, liquidity behavior, and risk dynamics, with a profess...

Explore mean reversion strategies in stocks through a structural lens. Learn why prices revert, when reversion fails, how risk behaves, and ...

Learn how to start investing in stocks with a long-term mindset, focusing on structure, discipline, risk management, and sustainable wealth ...

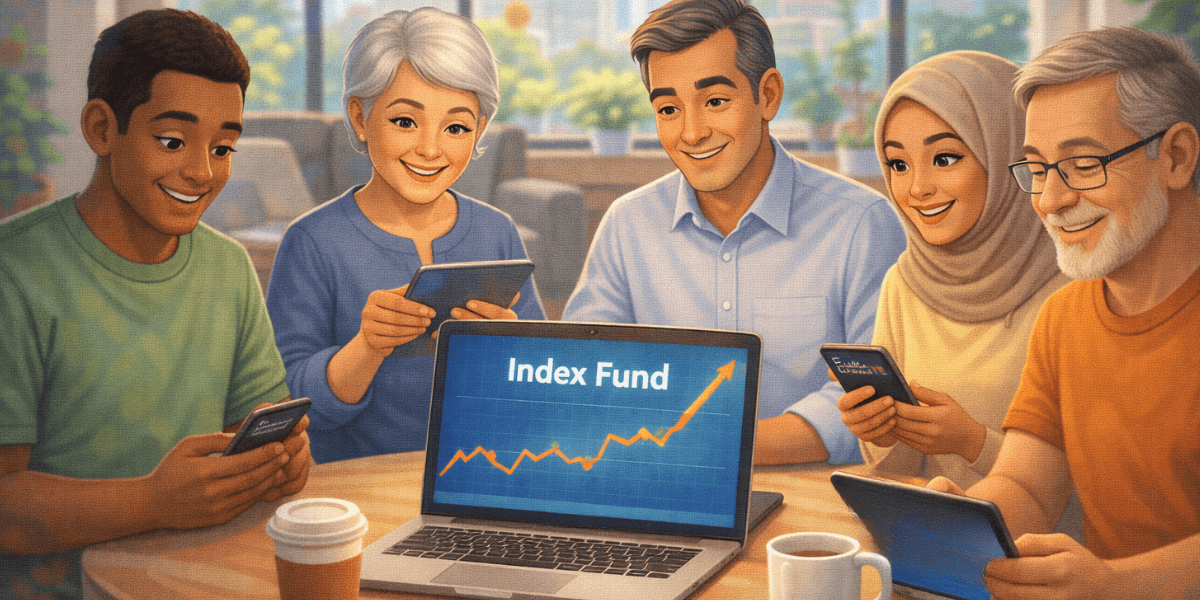

Compare active vs passive stock investing through a structural lens, analyzing risk, costs, behavior, and why passive strategies dominate lo...

Discover how index investing reduces risk by minimizing concentration, behavioral errors, and structural fragility, while aligning portfolio...

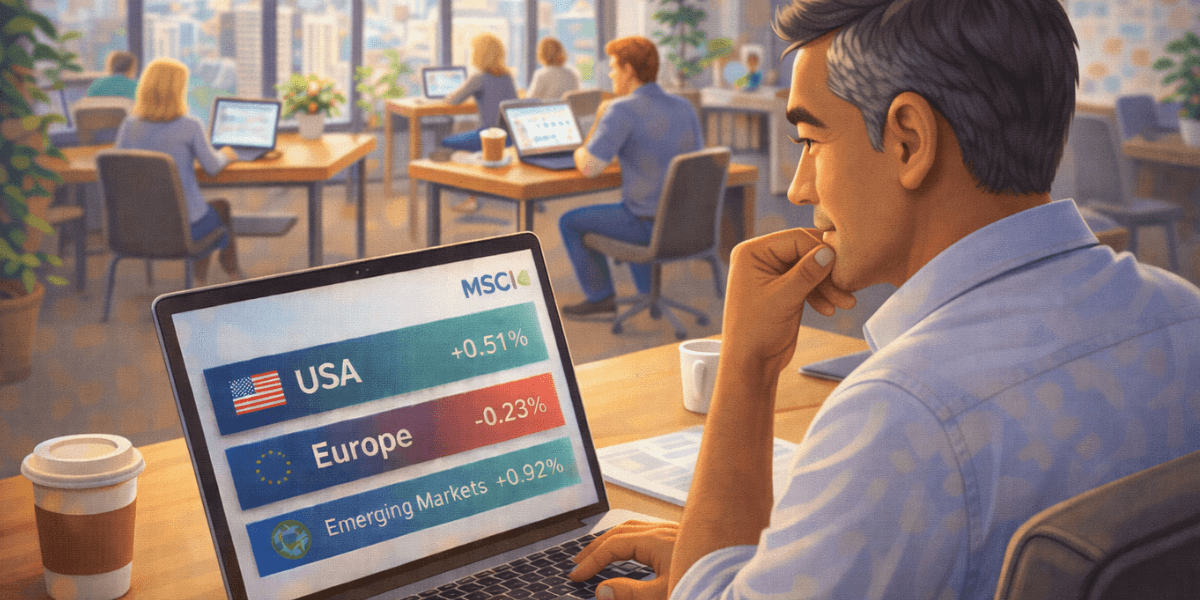

Understand what the MSCI Index is, how MSCI classifies global equity markets, why its indices move trillions in capital flows, and why this ...

Discover how trading volume affects stock trades, execution quality, slippage, and liquidity, and why volume alone is a poor proxy for real ...

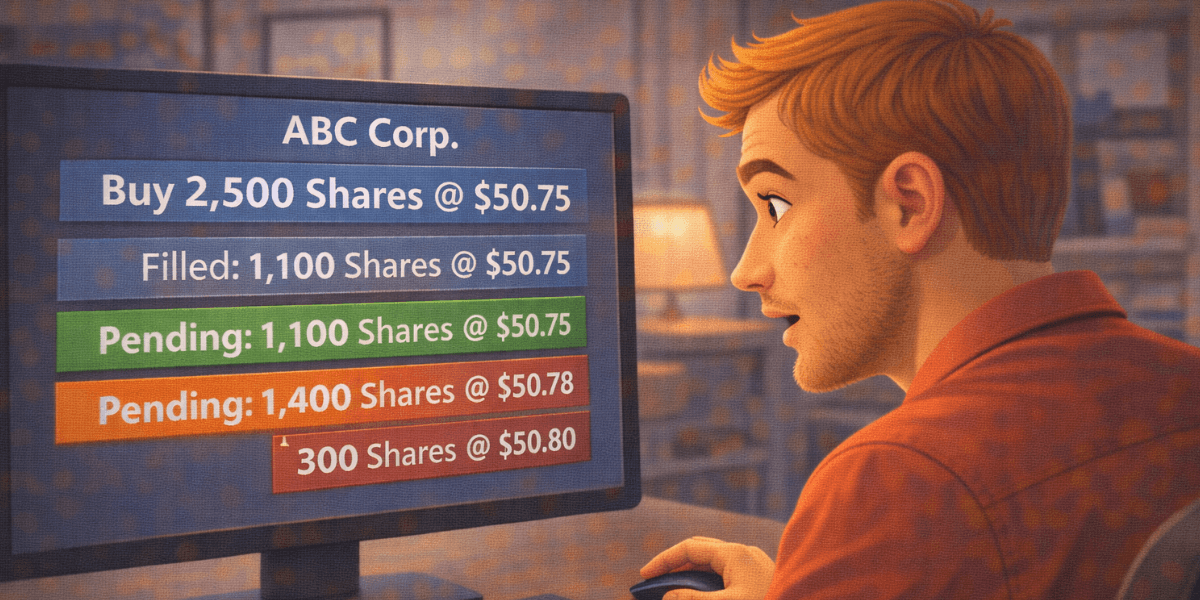

Learn how order size affects stock execution, market impact, slippage, and liquidity consumption, and why sizing decisions are critical for ...

Learn how to read Level 2 data in stock trading, understand market depth and order flow, and improve execution, slippage control, and liquid...

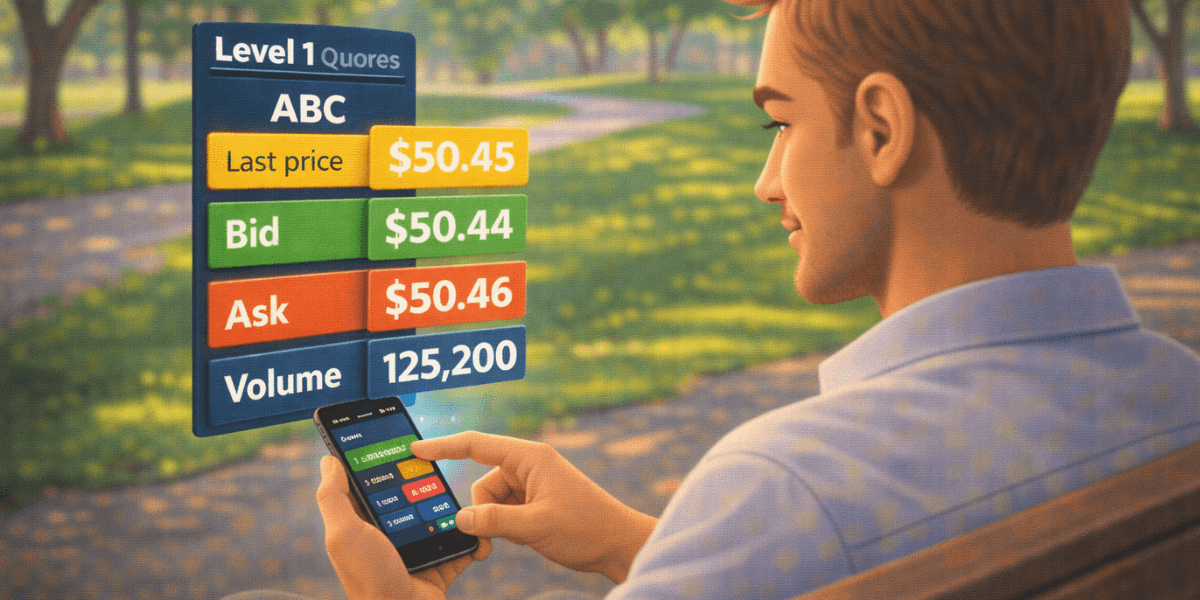

Learn how to read Level 1 stock quotes, including bid, ask, last price, and volume, and understand how they impact execution, liquidity, and...

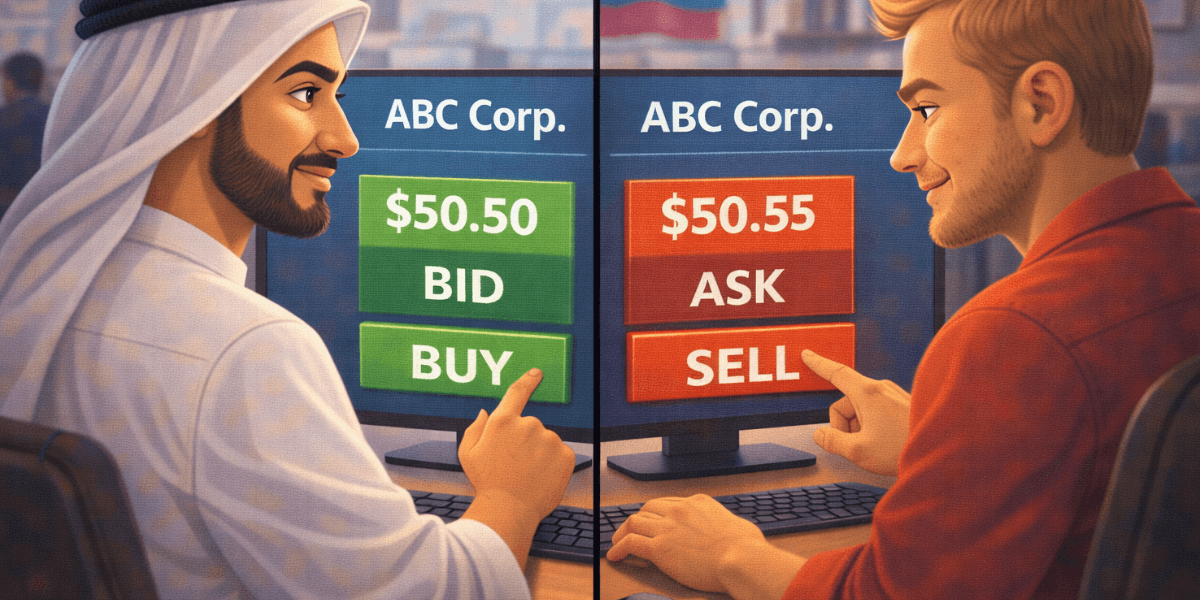

Learn what bid and ask prices really mean in stock trading, how they affect execution costs, liquidity, and pricing, and why they matter for...

Learn how slippage happens in stock trading, why execution prices differ from expectations, and how liquidity and market structure affect in...

Learn what market capitalization is, how it is calculated, and why it matters for liquidity, volatility, and risk when investing in stocks a...

Learn how supply and demand drive stock prices, how liquidity and order flow shape markets, and why these forces matter for investors across...

Learn how stock prices are determined through supply and demand, liquidity, valuation, and investor behavior, with a practical focus on GCC ...

Learn what a stock ticker symbol is, how it works across global markets, and why understanding tickers matters for trading, execution, and r...

Learn how foreign stocks trade on U.S. exchanges, including ADR structures, direct listings, liquidity, taxation, and key risks for investor...

Learn what ADRs are, how they work, their structure, risks, taxation, and why they matter for GCC investors investing in international stock...

Learn what the Qatar Stock Exchange is, how it operates, its regulation, trading structure, liquidity, and why it matters for investors acro...

Explore the key differences between Saudi and UAE stock markets. Learn how Tadawul, ADX, and DFM differ in liquidity, regulation, volatility...

Learn how stock trading works in the UAE, including ADX and DFM market structure, regulation, liquidity, trading sessions, and investor beha...

Learn how the Abu Dhabi Securities Exchange (ADX) works, including regulation, trading structure, liquidity, listed companies, and why it ma...

Learn what the Dubai Financial Market (DFM) is, how it operates, its regulation, listed companies, and why it matters for investors across t...

Understand the trading hours of the Saudi Stock Exchange. Learn how Tadawul sessions, auctions, liquidity, and volatility affect stock tradi...

Discover why stocks consistently outperform other assets over the long term. Learn how compounding, earnings growth, inflation resilience, a...

Understand the key differences between stocks and bonds. Learn how risk, return, volatility, and economic cycles shape their role in long-te...

Explore the fundamental differences between stocks and gold. Learn how growth assets and preservation assets behave across cycles, inflation...

Learn why stocks tend to offer more predictable long-term returns than commodities. Explore cash flows, compounding, volatility, cycles, and...

Learn how stocks and commodities behave differently across inflation, growth, recessions, and shocks. Understand volatility, correlations, a...

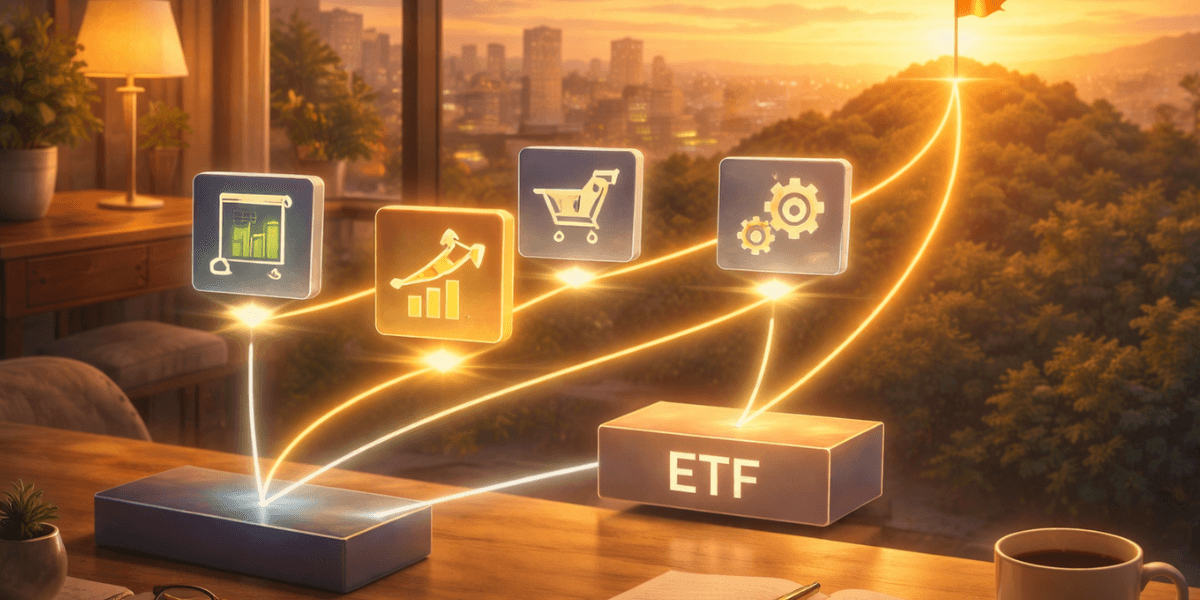

Discover when owning individual stocks can outperform ETFs. Learn how control, conviction, Sharia screening, dividends, and portfolio precis...

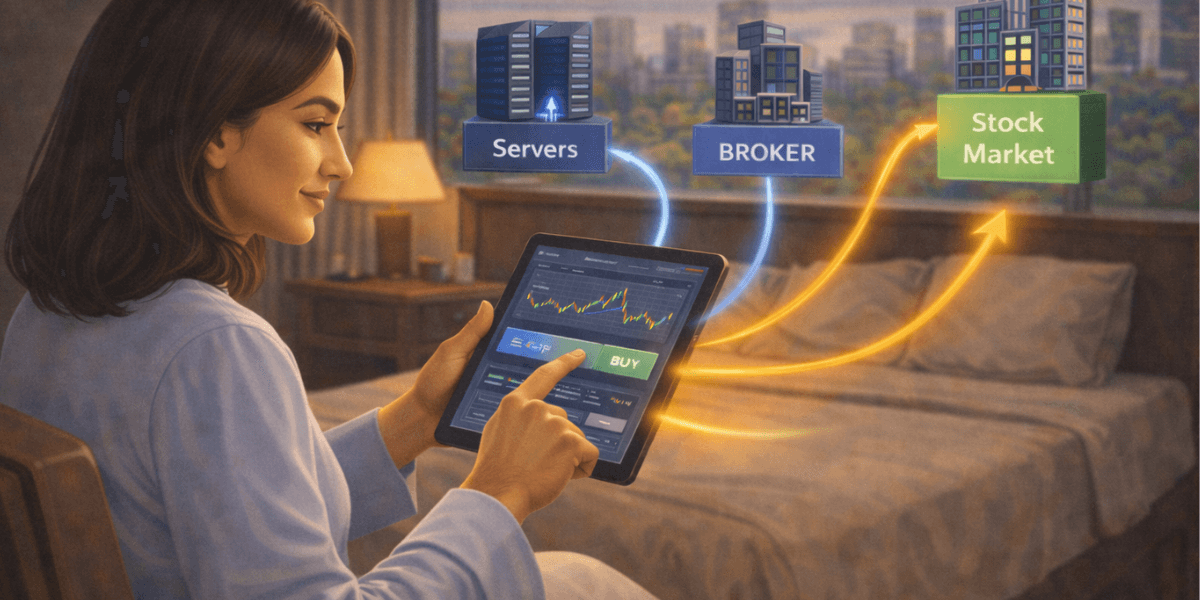

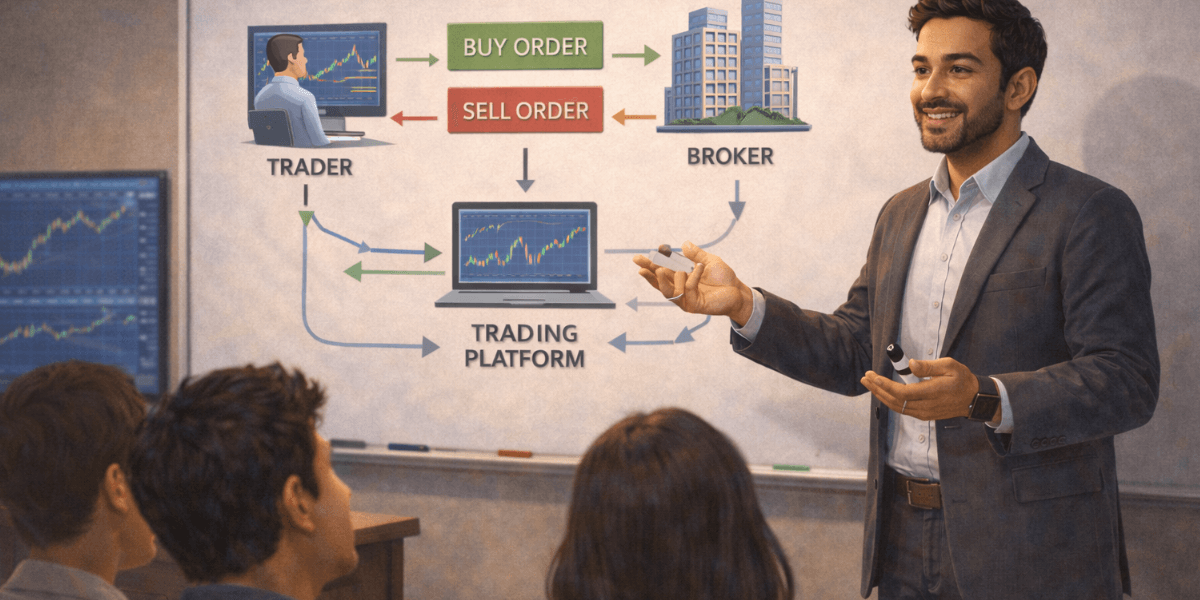

Learn how stock trading platforms handle trade execution, including validation, routing, liquidity interaction, and post-trade reporting, wi...

Learn how orders are placed through stock trading platforms, from validation and routing to execution and reporting, with a deep analysis fo...

Explore the differences between desktop, web, and mobile trading platforms for stocks, with a deep analysis of execution, behavior, and risk...

Learn what a stock trading platform is, how it works, and why it matters for execution, risk, and behavior, with a deep analysis tailored fo...

Learn how stock trading platforms work, from price feeds and order execution to reliability, security, and behavioral impact, with a deep an...

Learn when diversification stops working, why correlations spike during market stress, and how GCC investors should think about portfolio co...

Learn what portfolio risk really is, how it emerges from structure and exposure, and how GCC investors can control risk in global stock port...

Discover why overexposure is dangerous in stock investing, how concentration amplifies volatility and drawdowns, and why GCC investors must ...

Learn how much capital to risk on a single stock, how position size affects drawdowns and volatility, and how GCC investors should manage ri...

Learn how position size affects portfolio risk, drawdowns, volatility, and long-term compounding, with a deep analysis tailored for GCC inve...

Learn how central bank decisions impact stocks, valuations, liquidity, and investor behavior, with a deep long-term analysis tailored for GC...

Discover why some stocks benefit from higher interest rates, with a deep structural analysis of cash flow, leverage, pricing power, and inve...

Learn why rising interest rates hurt some stocks more than others, with a deep structural analysis of valuation, leverage, and cash flow for...

Learn how interest rates affect stock markets, valuations, and investor behavior, with a deep long-term analysis tailored for GCC investors ...

Learn what earnings season is, why it matters for stock prices, and how GCC investors should interpret earnings reports, guidance, and marke...

Learn how earnings expectations drive stock prices, why surprises matter more than results, and how GCC investors should interpret earnings ...

Learn what Return on Equity (ROE) really measures, how to interpret high and low ROE, and how GCC stock investors can use ROE to evaluate bu...

Learn why a low P/E ratio can be a warning sign, how value traps form, and how GCC stock investors should interpret low valuations in global...

Discover when a high P/E ratio makes sense, with a deep valuation analysis focused on growth visibility, business quality, and risk for GCC ...

Learn what the P/E ratio really means, how to interpret high and low valuations, and how GCC stock investors should use P/E when analyzing g...

Learn how to interpret EPS growth correctly, with a deep analysis of earnings quality, buybacks, margins, and cash flow for long-term GCC st...

A deep explanation of earnings per share (EPS), covering how it is calculated, how it can be distorted, and how investors in GCC markets sho...

An in-depth guide to trend following strategies in stock trading, explaining how trends form, how to manage risk, and how GCC market structu...

A deep guide to pullback trading strategies for stocks, explaining how pullbacks form, how to separate healthy retracements from reversals, ...

A deep guide explaining how to trade stock breakouts conservatively, focusing on risk management, execution discipline, false breakouts, and...

A deep analysis of false breakouts in stock trading, explaining liquidity traps, stop-driven moves, market psychology, and why false breakou...

An in-depth explanation of breakout trading in stocks, covering market structure, false breakouts, volume, volatility, risk management, and ...

A comprehensive guide on how to build a dividend stock portfolio, covering stock selection, diversification, reinvestment, risk management, ...

A deep guide explaining how to reinvest dividends in stocks, covering compounding effects, reinvestment strategies, behavioral discipline, a...

An in-depth analysis of how dividend investing builds long-term wealth through compounding, income reinvestment, risk reduction, and why it ...

A comprehensive guide explaining what dividend stocks are, how dividends work, why companies pay them, and how GCC investors can use dividen...

A deep analysis of how to balance growth and value in a stock portfolio, explaining risk, valuation, income, market cycles, and how GCC inve...

A deep guide on how to avoid bad fills when trading stocks, explaining execution quality, liquidity, slippage, order choice, and how GCC inv...

An in-depth guide to stop-limit orders in stock trading, explaining how they work, execution risks, non-execution scenarios, and how investo...

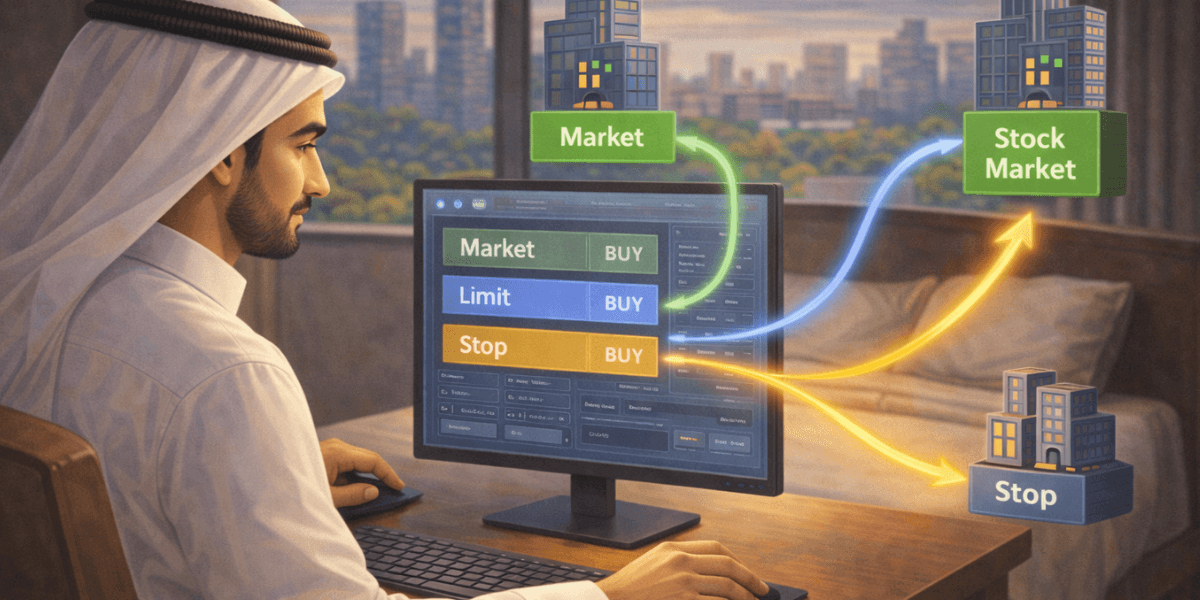

A detailed explanation of stop orders in stock trading, covering how they work, execution risks, volatility effects, and how investors in GC...

A detailed guide to limit orders in stock trading, explaining how they work within the order book, their advantages, execution risks, and wh...

A deep explanation of what a market order is in stock trading, how it works inside the order book, its risks, slippage effects, and when inv...

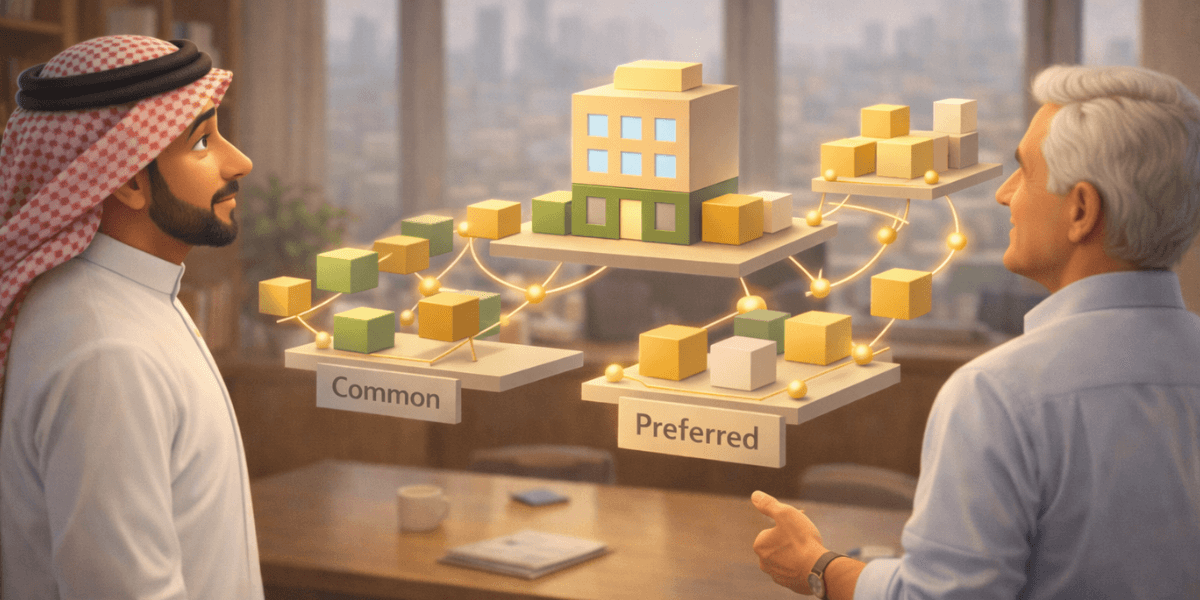

A detailed explanation of common shares and preferred shares, covering ownership rights, dividends, risk, voting power, and how each type fi...

A detailed explanation of the difference between shares and stocks, clarifying equity ownership, investment terminology, and why the distinc...

A deep explanation of what happens before, during, and after an IPO, covering company preparation, pricing, investor behavior, post-IPO trad...

A deep explanation of what an IPO is, how the initial public offering process works, why companies go public, and how IPOs affect investors ...

A deep, structured explanation of how companies list their shares on a stock exchange, covering preparation, regulation, pricing, allocation...

An in-depth guide to Tadawul explaining how the Saudi stock exchange works, including market structure, regulation, Sharia influence, taxati...

A deep analysis of how IPOs work in the Saudi stock market, covering regulation, pricing mechanics, retail allocation, Sharia compliance, ta...

A detailed explanation of the Nomu Market in Saudi Arabia, covering its purpose, listing structure, investor eligibility, risks, Sharia cons...

A complete beginner’s guide to investing in Saudi stocks, explaining how Tadawul works, who can invest, Sharia considerations, risk ma...

A deep, professional analysis of Tadawul explaining how the Saudi stock market works, including market structure, investor access rules, Sha...

A deep analysis of GCC stock markets covering Saudi Arabia’s Tadawul, UAE stocks, Sharia-compliant investing, regional rules, taxation...

A deep, practical explanation of how stock markets work across the GCC, covering exchanges, regulation, liquidity, investor behavior, and lo...

Explore the real difference between stocks and ETFs with a deep long-term analysis of risk, control, and diversification for GCC-based inves...

Discover why stocks offer more transparency than crypto, with a deep analysis of disclosure, accountability, and investor protection for GCC...

Compare stocks vs crypto through ownership, risk, and volatility, with a deep long-term analysis for GCC investors building global portfolio...

Learn why stocks are less speculative than forex, with a deep structural analysis of ownership, compounding, and risk for long-term GCC inve...

Compare stocks vs forex and understand the key structural differences in ownership, risk, and compounding, with a long-term perspective for ...

Compare stocks vs other assets and understand which fits long-term investors best, with a deep analysis for GCC investors building global po...

Learn what to check before opening a stock brokerage account, including regulation, custody, costs, and execution, with a deep focus on GCC ...

Learn how to choose a stock broker based on your needs, with a deep analysis of execution, costs, regulation, and custody for GCC investors ...

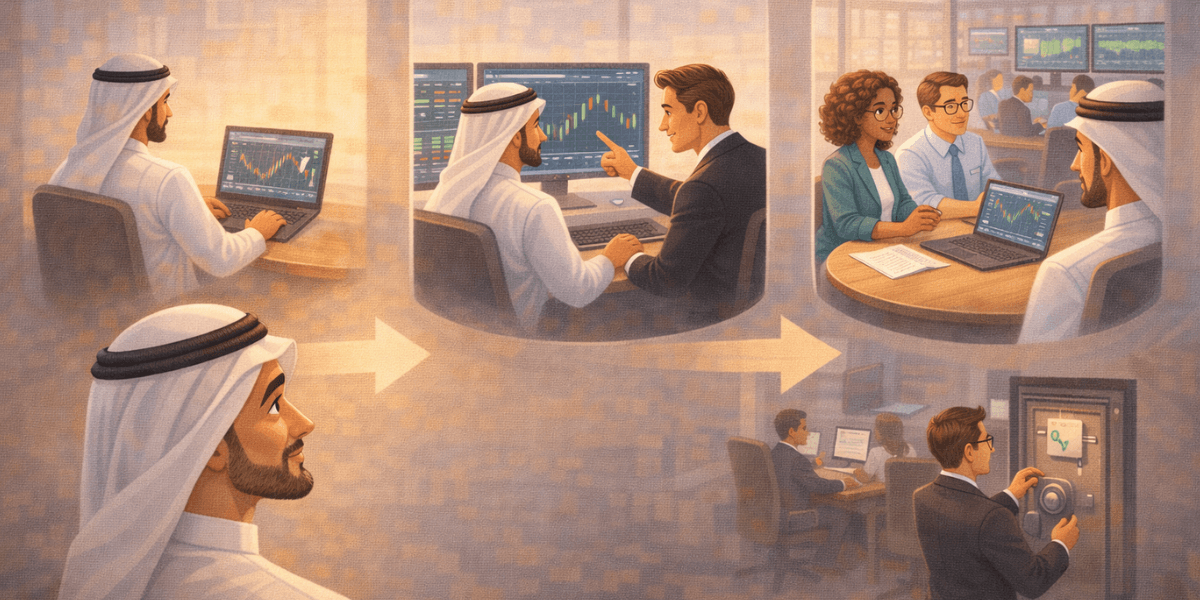

Compare online stock brokers vs traditional brokers and understand how each model affects execution, ownership, and risk for GCC-based inves...

Learn the main types of stock brokers, how each one works, and why broker type matters for GCC-based investors accessing global equity marke...

Learn how stock brokers work step by step, from order placement to settlement and custody, and why understanding broker mechanics is critica...

Learn what a stock broker is, what they actually do behind the scenes, and why broker choice is critical for GCC-based investors accessing g...

Learn how to calculate position size for stock trades using risk-based sizing, volatility, and portfolio context. A professional guide for G...

Learn what position sizing is in stock trading, how it defines risk before trades are placed, and why it is essential for GCC-based traders ...

Learn how to measure risk in stock investing, why downside and portfolio structure matter more than volatility, and how GCC-based investors ...

Learn how professional stock investors think about risk, why they prioritize capital preservation over prediction, and how this mindset bene...

Learn why risk management matters more than returns in stock trading and investing, how downside control enables compounding, and why this p...

Learn what risk management means in stock trading and investing, how it protects capital across market cycles, and why it is essential for G...

Learn why stocks sometimes fall after strong earnings, how expectations and valuation drive post-earnings reactions, and what GCC-based inve...

Learn which parts of earnings reports matter most for stock investors, how to filter noise from signal, and why this skill is essential for ...

Learn how to read an earnings report as an investor, how to interpret revenue, margins, cash flow, and guidance, and why this skill is essen...

Learn why most financial news does not matter for stocks, how markets price expectations in advance, and why ignoring noise is critical for ...

Learn how stock market news actually affects prices, why expectations matter more than headlines, and how GCC-based investors should interpr...

Learn why cash flow matters more than profits in stock investing, how cash reveals business sustainability, and why this principle is critic...

Learn how to read a cash flow statement step by step, how to analyze operating and free cash flow, and why cash flow matters for GCC-based i...

Learn how to read a balance sheet for stock analysis, how to evaluate liquidity and leverage, and why balance sheet strength matters for GCC...

Learn how to read a company’s income statement step by step, what each section reveals about business performance, and why this skill ...

Learn how fundamental analysis works step by step, from understanding the business to valuation and risk, and why this process matters for G...

Learn what fundamental analysis in stocks really is, how it evaluates business value and financial strength, and why it matters for GCC-base...

Learn what creates momentum in stocks, how information flow, institutional capital, and psychology drive price continuation, and why underst...

Momentum trading in stocks explained in depth. Learn how momentum strategies work, their risks, and why momentum trading can suit GCC-based ...

Learn how swing traders approach stock markets, how they analyze structure and risk, and why swing trading fits GCC-based traders accessing ...

Swing trading stocks explained in depth. Learn how swing trading works, its strategies, risks, and why it suits GCC-based traders accessing ...

Learn how stock trading strategies actually work, how they manage risk and uncertainty, and why structured systems are essential for GCC-bas...

Learn what a stock trading strategy really is, how it works in equity markets, and why having a structured system is essential for traders i...

Learn the differences between growth and value stocks, how each behaves over market cycles, and why balancing both matters for long-term inv...

Discover what makes a stock suitable for long-term investing, how to evaluate business quality, and why these criteria matter for investors ...

Learn how to build a long-term stock portfolio, how to structure diversification and position sizing, and why this approach fits investors i...

Learn how long-term investors think about stocks, why they focus on businesses instead of prices, and how this mindset fits investors operat...

Discover why long-term stock investing works, how compounding and business growth drive returns, and why patience matters in global equity m...

Learn what stock investing is and how it differs from trading, including time horizon, risk, discipline, and decision-making. An equities-on...

Learn how stock orders work, including market orders, limit orders, and execution mechanics. A clear equities-only guide designed for intern...

Learn what you need before placing a stock trade, from account readiness and market access to risk control and execution planning. An equiti...

Learn how to place your first stock trade step by step, from preparing your account to executing your first order. A clear equities-only gui...

Learn how stock trades are executed step by step, from order placement and routing to execution and settlement. A clear equities-only guide ...

Learn how to sell stocks step by step, including when to sell, how to place sell orders, manage risk, and avoid emotional decisions. An equi...

Learn how to buy stocks step by step, from choosing a broker to placing your first order. A practical equities-only guide designed for inter...

A detailed explanation of how NASDAQ works and how it differs from other stock exchanges, including its structure, trading model, and role i...

A clear explanation of how the New York Stock Exchange works, including listing rules, trading mechanics, and price discovery. An equities-o...

A simple, equities-only explanation of what a stock exchange is, what it does, and why it matters for investors. Learn how exchanges support...

Learn how stock exchanges work step by step, including order placement, matching, execution, clearing, and settlement. A clear equities-only...

Discover what stocks are, what owning shares really means, and why companies issue equity to raise capital. A clear, practical explanation f...

Learn what the stock market is, how it works, and how stocks are traded on major exchanges like NYSE, NASDAQ, and Tadawul. A clear, practica...